Wow. What an incredible past few weeks it has been for our country’s health, economy, and local real estate markets.

News and data are changing rapidly from one week to the next.

Just a few weeks ago there were talks of another Great Depression, while today some pundits believe recent Fed actions will boost the economy.

Just a few weeks ago, the United States projected death rate was between 100,000 to 240,000 compared to today where projections are 60,000.

In the middle of March, some prognosticators were estimating 3 million unemployed a week. Today, we have been seeing 6 million.

Change is happening at lighting speed.

Real Estate Comparisons

While current sellers are looking for buyers, and current buyers are scouring the market for inventory…real estate will still react slowly.

I am putting the cart before the horse, but I thought it might be interesting to see how our markets are responding to the Coronavirus when compared to other times in past history.

More specifically, how did the market react during times of shock like the Northridge Earthquake, the September 11th terrorist attacks, and the Great Recession?

Los Angeles County sales in March were down 2.7% compared to March of last year.

That number will likely get significantly worse if you look at the pending sales data in March and how that will affect April and May closed sales. Could we see 50% sales drops or higher?

No one knows.

That said, let’s look at past California Association of Realtors (C.A.R.) data for a guide of what has happened to see what could happen…

Northridge Earthquake

The Northridge Earthquake hit L.A. County on January 17, 1994.

Much like the Coronavirus, the quake hit in the middle of the month and shut down various parts of the L.A. County economy. You would think sales and prices would drop?

Year-over-year, L.A. County sales in January and February looked like this after the earthquake:

- Jan 1994: 28.2%

- Feb 1994: 37.9%

There was an increase in sales volume as you can see and those 20 to 30% increases continued through August of 1994.

Here is what 1994 median prices looked like in L.A. county:

- Jan 1994: $194,000

- Feb 1994: $184,000

- Mar 1994: $184,000

Prices dropped by about 5% while heading into the busy spring selling season.

These numbers do not seem half bad after the economic shock of a huge earthquake, but it is hard to really gain true insight for a few reasons.

Sales were sluggish in 1993, setting up for easy comps in 1994.

- Jan 1993: 0.6%

- Feb 1993: -23.1%

You can see how sales growth was weak the year prior.

There was also a slumping to flat trend in real estate median prices in L.A. County starting in 1991 that did not bottom out until 1997 from larger macro-economic trends.

In 1991, the median price peaked in the $230,000s. And there were actually rising median prices in the summer of 1994 after the earthquake.

In 1997, we saw the base of the bottom form with median prices in the $150,000s to $160,000s before roaring back into the $200,000 in 1998.

It is really hard to draw any conclusions from this data with a shock and a real estate market already in a major downtrend.

September 11th Attacks

Take a look at the year-over-year sales data and median prices during the September 11th terrorist attacks.

2001 Year-Over-Year Sales Data:

- Sept 2001: -0.8%

- Oct 2001: 5.6%

- Nov 2001: -4.1%

You can see sales were choppy during the month and two months following the attacks, but the data generally recovered pretty quickly and median prices show that.

2001 Median Price Data:

- Sept 2001: $276,000

- Oct 2001: $244,000

- Nov 2001: $239,000

That is a fairly steep move, but it is not seasonally adjusted to take into account slower winter months where prices normally drop.

See below for the 2002 Median Price Data in the same period a year later:

- Sept 2002: $325,000

- Oct 2002: $294,000

- Nov 2002: $288,000

The median price data in L.A. County is pretty compelling showing how fast the real estate market bounced higher after 9/11 just a year later. It is almost a 20% rise.

The Great Recession

The Great Recession is really an event unto itself.

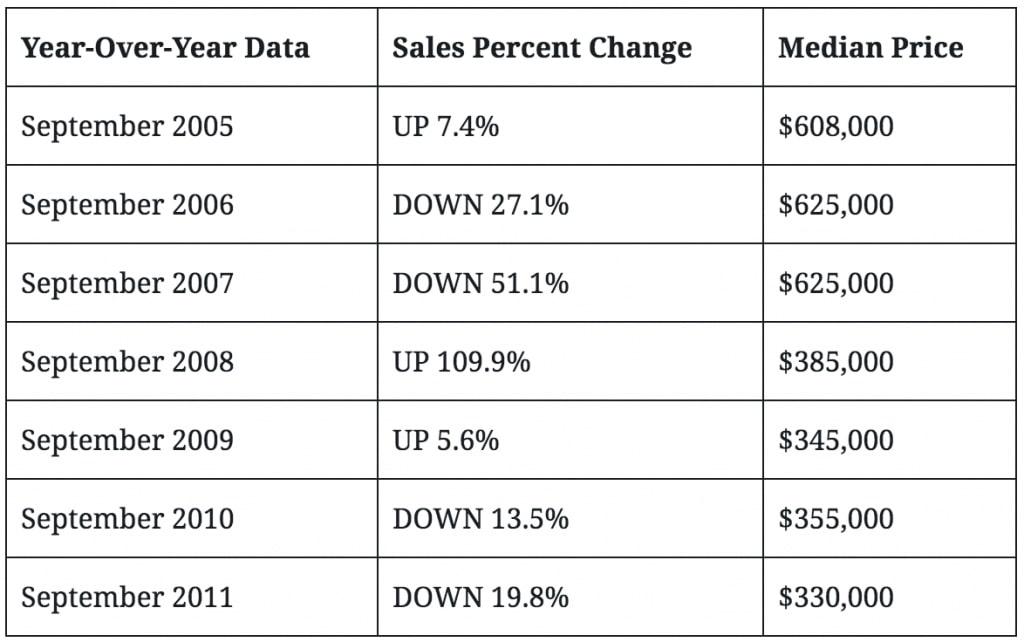

I will take September year-over-year data to look at over a period of time to give you an idea of how crazy it was and the moves we saw over a number of years in L.A. County…

Honestly, I don’t even know what to make of that data. And quite frankly, it would be impossible to even have a clear picture with all of the Fed stimulus, people losing their homes, and banks on the brink of bankruptcy.

We do see serious drops in sales year-over-year just like pending sales are suggesting today, but there were crazy swings for years during the Great Recession. We are just beginning this process with our Coronavirus data and it is just too speculative to think of how the next months will shake out and if they can even compare to the numbers above.

So what insight can the Northridge Earthquake, 9/11, and the Great Recession tell us?

Absolutely nothing.

Each and every event is unique in its own nature and a novel virus pandemic is certainly its own beast.

Not to mention the stimulus that we are seeing is well beyond what we received during the Great Recession. It is truly unprecedented and it is IMPOSSIBLE to predict what will happen over the course of the next couple of months in our local markets.

I think past events are a poor example of how this will all unfold.

Throw everything out the window when trying to compare these times.

As a general rule of thumb, all of your real estate moves need to be made with the very long term in mind.

I think it is worthwhile mentioning some recent news today if you do not follow how things are changing daily. Let’s start with the negative and end with the positive.

Negative News

Unemployment numbers were released this morning and the fresh data pushed the three-week unemployment claims to 16 million. That is insane.

To put that in perspective for you, experts are saying that means the current unemployment rate is over 10%. The Great Recession reached 10% in 2009 after many months.

So today, we exceeded the Great Recession unemployment rate in just three weeks.

Experts believe the real-time unemployment rate is closer to 15% currently because unemployment offices are overwhelmed, many workers are furloughed and cannot apply for benefits, and thousands of employers are holding onto employees because of the PPP forgivable loan program.

The Great Depression hit an unemployment rate of 24.9%. We still have a long way to go before we reach that number, but the Federal government is offering incredible stimulus to keep numbers from climbing to those levels.

It is not pretty from a jobs perspective and it will likely have a huge effect on the economy and real estate markets.

Positive News

After the horrible unemployment numbers, The Fed announced that it was opening another $2.3 trillion in lending capacity on top of what has already been done.

Based on my early readings, they expect to lend/buy on virtually everything but stocks. They will lend to middle to large-sized businesses, purchase investment-grade bonds, purchase junk bonds, and even potentially ETFs.

It could be one of the most extraordinary efforts of financial stimulus in a long time, if not ever.

This should take a lot of bankruptcies off the table for many companies that were having trouble borrowing money to keep their doors open. This is a great sign and a huge positive for an economy that may have been in dire straights without it.

If The Fed is using another $2.3 trillion of stimulus, and this quickly, they must have believed the situation we were in with the virus (economically speaking) was about as bad as it could possible get.

Saving businesses and extending vast amount of credit is the right thing to do at this time.

Conclusion

To wrap this all up, no one knows what will happen next.

Predicting where the real estate market will go next is silly. And, past economic shocks do not give us any clear insight either.

The unemployment news is horrible, the stimulus is a breath of fresh air, and all we can hope for is that the real estate market can stabilize in the next few months to allow for us to begin making some sound decisions.