Last week, I had the wise idea of doing an “instant” reaction to the California proposition results that affected real estate throughout the state.

I should have known better.

Here we sit on Friday still without official results as the votes are still being counted. According to the Associated Press, via Google search: “CA proposition results,” there are 76% of the votes being reported.

With just over three quarters of the votes counted, this is how the key real estate propositions look as of this morning, Friday, November 6th.

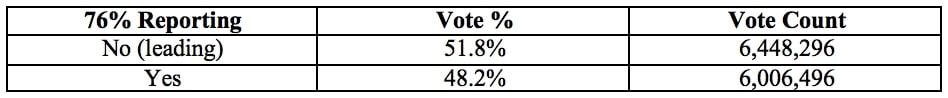

California Proposition 15: Change in Commercial Property Tax:

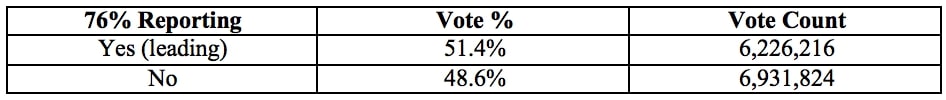

California Proposition 19: Change Property Tax Rules:

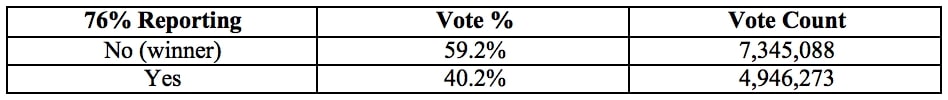

California Proposition 21: Local Government Rent Control:

In case you wanted a summary of each bill, you can find my October 2019 blog post breaking down all three propositions here.

Please note, the above vote counts are not final, and the numbers can change at any moment.

This is 2020…remember, anything can happen!

That said, should the vote count swing in another direction, then I will be sure to edit this blog with the most up-to-date information.

Proposition 15: Commercial Property Tax Assessment for Schools/Local Gov’t

The goal of Proposition 15 was to remove the 1978 Proposition 13 and allow for most commercial properties to be reassessed to market value. As much as $12.5 billion a year, according to the L.A. Times, would be raised and the money would be used to fund schools and local government operations.

At this point in time, it looks like California voters will reject Proposition 15.

This result is a huge sigh of relief for commercial property owners and their tenants. While some argue that tenants would foot the bill, others argue that landlords would ultimately pay. In the end, it seems that this exceptionally large new tax will likely be defeated.

Lawmakers, schools, and local governments are hungry for more funds and Prop 13 is a huge roadblock in finding new revenue through property taxes. With how close the results are, another proposition surrounding this bill will most definitely come in the next two to four years.

This is not the last time California voters will decide the fate of property assessments for commercial property owners.

If you are a commercial landlord or tenant, you would be wise to negotiate protections into your lease going forward if property taxes are reassessed to current market rates.

Proposition 19: Tax Portability & Intergenerational Tax Transfer Reform

Remember, this proposition had two, quite different parts to it.

Part One of this bill addressed tax portability changes allowing mostly homeowners over 55 to transfer their property tax basis anywhere in the state for equal or lesser value up to three times.

Part Two addressed the removal of most property tax protections for children or grandchildren inheriting property from parent’s or grandparent’s old property tax assessments.

At this point in time, it looks like California voters will accept Proposition 19.

This result is a huge win for seniors and a drastic loss for wealthy landowners hoping to pass along generational property.

Seniors will now have up to three times to transfer their property tax base at an equal or lesser value. Supporters argue it will allow for more mobility throughout the state and free up housing to younger generations.

Wealthy landowners lose big because all investment property will now be reassessed when passed along to children or grandchildren. Primary residences will only be protected if that child or grandchild uses the property as a primary residence and only an additional $1 million value will be protected.

According to C.A.R.’s research, this tax protection removal on primary residences would only affect 5% the transfers (the largest transfers), but that is assuming that heirs use homes as primary residences which may not be the case in every situation.

Proposition 21: Local Rent Control Initiative

This proposition was set to replace the 25-year-old Costa Hawkins Act that was passed back in 1995.

Local governments would have the power to enact rent control, even beyond the newly passed California rent control law known as the Tenant Protection Act of 2019.

This vote has already been called as California as citizens overwhelmingly voted no on this measure.

The result of this vote is a win for landlords, especially landlords in liberal cities. Although landlords were unhappy with the state rent control act last year, it has very light controls, where very few landlords raise rent beyond 7.5% or so in a year. The state law is hardly overbearing.

Landlords in conservative cities faced less risk of tighter rent control restrictions whereas landlords in liberal cities could have faced tighter restrictions much like the city of Los Angeles’ very strict controls.

There have been two or three propositions on rent control initiatives over the past few election cycles and they have all been soundly defeated. Even in the liberal state of California, its residents do not believe in the merits of rent control.

Conclusion

There you have the presumed results and some additional context.

Rent control was resoundingly defeated yet again.

Seniors win big on property tax transfers, while wealthy landowners will have their properties reassessed (for the most part) when their children or grandchildren inherit their property.

And lastly, Proposition 15 looks to have been defeated by the slimmest of margins. Commercial landlords should prepare themselves for another ballot measure or two looking to reassess their properties to market value.

If rent control was tried multiple times and defeated by wide margins, you can expect commercial reassessment to be tried yet again as Californians seem very closely divided on the topic. Be sure to address this risk in your commercial property leases whether you are an owner or a tenant.

See you next week.