To begin March 2020, I wrote two blog posts in response to early reports on the novel Coronavirus.

It was still early in our country’s reaction to the pandemic, so I got a lot of push back for these posts. Some said I was an alarmist and overreacting.

If you care to refresh your memory on those posts, I have linked them below:

- March 5th, 2020: “Coronavirus: How to Play the South Bay Real Estate Market”

- March 12th, 2020: “Hermosa Condos are Safe Amidst Uncertain Times”

These were not predictions, but the best conservative advice I could offer during a potentially scary 100-year event. All in all, I am proud of these posts because when looking back, they would have served a lot of people very well.

For this week, I am going to revisit the “Hermosa Condos are Safe Amidst Uncertain Times” blog post. The reason I highlighted Hermosa condos back in March 2020 is because you could cash flow these units with a reasonable down payment thanks to the drop-in interest rates.

If you have read old posts, newsletters, or listened to my podcast, then you know I was bullish on condos at the beginning of 2021 thanks to rollout of the Corvid vaccines.

Am I recommending flips or short term plays for Hermosa condos? No.

Rather, I am simply examining how they stack up today, that times are a little more certain than in early 2020.

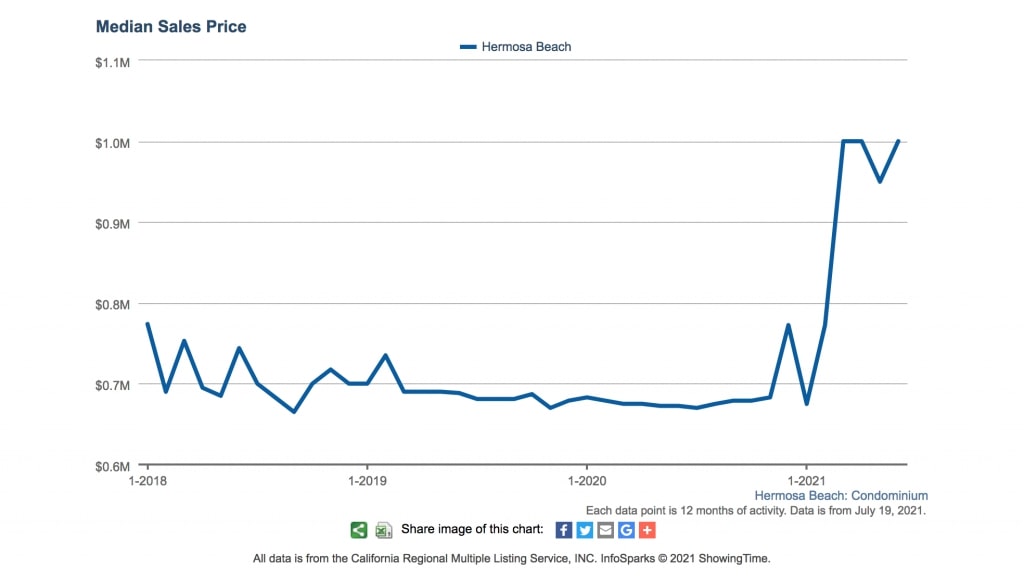

Below is a chart showcasing the steady prices of Hermosa condos and the recent jump that began in Q1 of 2021:

The Previous Condo Post Revisited

Below, I revisit the previous post and the old 2019 condo numbers to refresh your memory.

- 1720 Ardmore Avenue #223

- 2 beds, 2 baths, 857 sq. ft.

- Sold Price: $705,000

These are your expenses on the Ardmore condo…

- Rent: $3,200/mo.

- Expenses

- Interest-Only Payment: $1,650/mo.

- HOA Dues: $491/mo.

- Property Taxes: $700/mo.

- Walls-In Insurance: $75/mo.

- Maintenance Reserve: $100/mo.

- Total Expenses: $3,061/mo.

- Positive Cash Flow: About $200/mo.

***Remember, this above calculation was with a 25% down payment and an interest-only loan at 3.75% back in March of 2020.

This is why I recommend Hermosa condos, like the one above, as a safe bet during uncertain times. Affordability, cash flow, and a solid rental pool by the beach.

Now, let me try to compare, as best as I can, to 2021 and similar 1720 Ardmore Avenue sales at present-day rates…

Today’s Numbers & Comps

During the uncertain times, I calculated a higher, more conservative rate at 3.75%.

It is more than likely that one can land an even lower rate at this time. At 3.5% interest-only, you could boost your cash flow another $100 a month, and if you go a shorter-term fixed, then it is $200 per month.

Rents are still the same with a confirmed $3,200/mo. rental comp just a few months ago.

So, owners are likely now earning $300 to $400 per month in cash flow. Something that is almost impossible to achieve with just 25% down on property West of PCH.

In terms of comps, there are some nice 2021 sales in the 1720 Ardmore Avenue building:

- 1720 Ardmore Avenue #224 (neighboring unit)

- 2 beds, 2 baths, 986 sq. ft.

- Sold Price: $805,000

- 1720 Ardmore Avenue #209

- 2 beds, 2baths, 974 sq. ft.

- Sold Price: $855,000

Considering there were past 2-bed condo options around $705,000, the above are strong comps. To be fair, the old example I used in early 2020 was a smaller unit by 100 square feet. So, the gains are not quite as significant if we could find apples to apples comparisons.

That said, putting down about $175,000, earning around $8,000 in cash flow, and somewhere between $50,000 and $100,000 in appreciation gains looks to be a stable and no so bad bet during some of the most uncertain times in our markets.

There are condos with much larger gains, but of course, you sacrificed cash flow and had to endure negative cash flow.

How Does the Cash Flow Look Today?

Now, let’s break down cash flow numbers splitting the difference between with what look to be current prices at a median around $825,000.

- Rental Income: $3,200/mo.

- Less Expenses

- Interest Only Payment: $1,740/mo.

- HOA Dues: $491/mo.

- Property Taxes: $825/mo.

- Walls-In Insurance: $75/mo.

- Maintenance Reserve: $100/mo.

- Less Expenses

Today this condo sits at about break-even.

This time around I took an interest-only rate of 3.375% and obviously, 25% down, which is higher thanks to the bigger purchase price.

Even with a run higher in price, you can still break even on these condos. The juicy cash flow is not there anymore, but what I have seen in my career is that reasonable cash flow does not last long in the South Bay Beach Cities…and break even tends to be a great deal that does not last long either.

I think there will be a push higher in prices when penthouses in neighboring complexes officially close, like the one below…

- 1600 Ardmore Avenue #425

- 2 beds, 2 baths, 1,071 sq. ft.

- Active Under Contract Asking: $1,215,000

Conclusion

In short, Hermosa condos made for a steady investment in uncertain times. Now, their prices are beginning to grow and earning even stronger returns.

And, while South Bay condo prices have already surged much faster than many expected to start 2021, you can see that there is still a great value proposition by breaking even as an investor.

That also means even better deals for owner-occupied buyers who can essentially trade-in their $3,200/mo. two-bedroom rentals and own for the same price if they can come up with the down payment.

I have only seen South Bay renters be able to trade-in their rent for the same price of ownership a few select times over the past decade, and when it happens, it doesn’t last for long.

Look for continuing moves higher in Hermosa condos like these as the market gets more efficient as we return to normal.

Cheers.